What Is Gold and Silver Bullion and How Can You Buy It Safely?

Gold and silver have long been seen as timeless symbols of wealth. But today, bullion has become one of the most reliable ways to protect and grow value. Unlike paper assets, bullion is physical and tangible, offering a sense of security that many investors seek. In this guide, we will explain what gold and silver bullion are, why they remain reliable choices, and how you can buy them safely. By the end, you will know what is gold and silver bullion and how to protect wealth and avoid common mistakes.

Background of What is Gold and Silver Bullion

Let’s first give you a quick rundown on what is gold and silver bullion. Precious metals such as gold and silver bullion are popular as precious investment. The bullion is provided in form of bars, coins or round with a defined weight and purity. Investors prefer bullion because of its perpetual value and international fame. They are stable and are therefore an asset that would be best to uncertain markets.

Meanwhile, it acts as an insurance against financial security or as a means of hedging against inflation. Bullion offers a physical method of conserving and expanding wealth and retaining high levels of liquidity across global borders.

Major Reasons on Why Invest in Bullion

Store of Value

Gold and silver have been in use for long centuries as good stores of value. They are not easily diminished in value with time as it happens to paper money. The possession of the bullion provides the investors with a serenity. They have an asset that can withstand economic fluctuations without losing its international acceptance and recognition.

Hedge Against Inflation

The value of paper money declines when inflation is increasing. Gold and silver are precious metals, and they tend to move contrary to the wealth. Bullion Investment is a wise choice as it allows someone to maintain buying power across the board during fluctuating economic times around the globe.

Portfolio Diversification

Bullion is a great method of diversifying an investment portfolio. Gold and silver do not react in the market the way stocks or bonds do. With the introduction of bullion, investors decrease the total risks and create greater resiliency. Such a range of diversification secures greater financial stability and hedge against recessions, which guarantees balanced wealth increase.

Liquidity and Global Demand

Bullions of gold and silver are very liquid, that is, they can be readily changed into cash. The global market creates a constant demand, and the investors can sell the bullion anywhere globally. This makes it as one of the safest and realistic investment options in the present day.

Different Types of Bullion You Can Buy

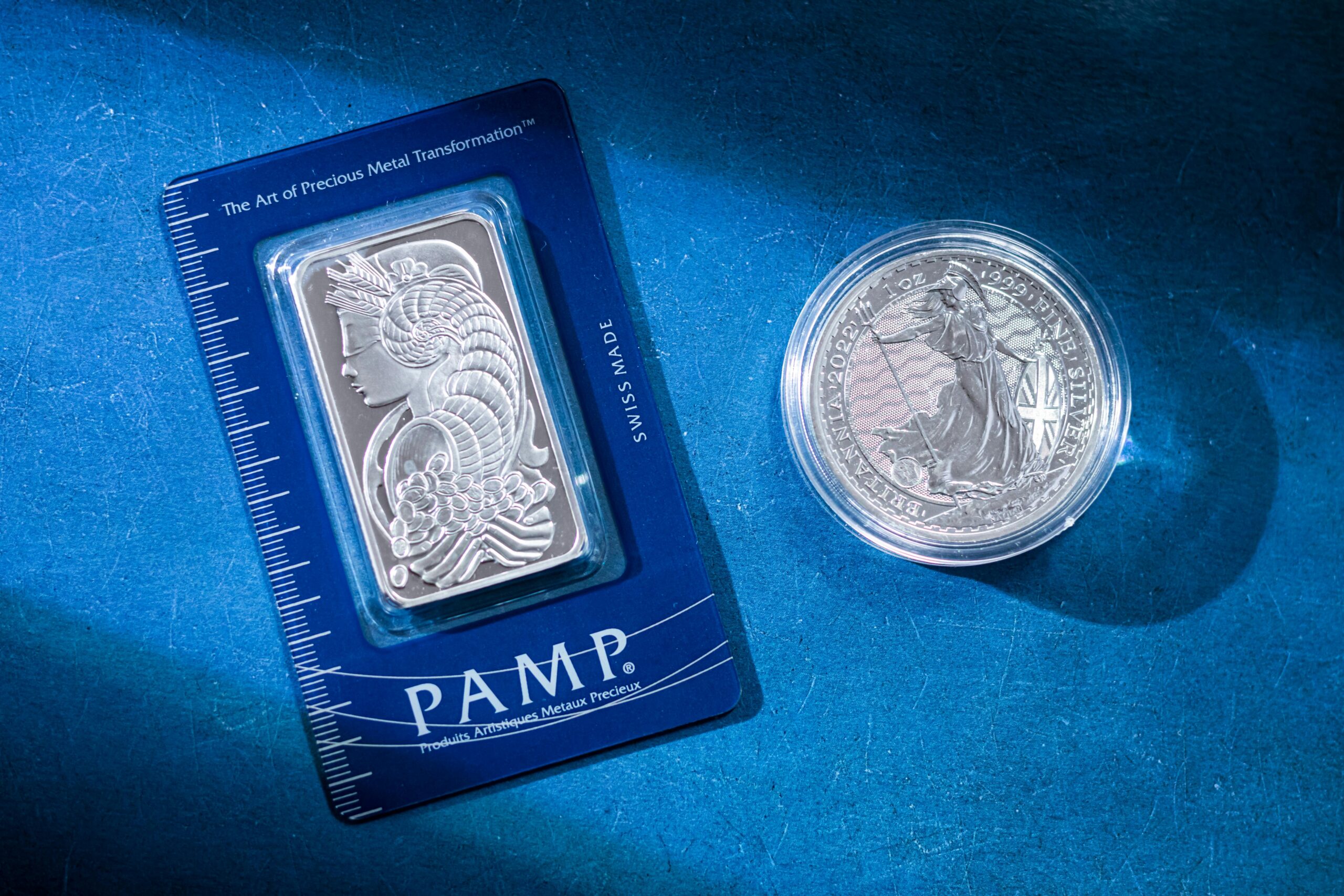

After knowing what is gold and silver bullion, it is important to discover what different types are available. There are a variety of alternatives that investors can choose when purchasing gold silver bullion, and each one meets several requirements. Gold and silver bars are the most prevalent. They are available in different weights and are very cost effective when investing in large quantities. Another common favourite is coins, which are usually minted by government and accepted internationally and thus are easy to exchange.

Flexibility is better provided by smaller denominations, and the larger sizes reduce the costs per ounce. Bullion presents purity and weight transparency whether in coins, rounds or bars. These products offer new and seasoned investors a secure manner of owning precious metals easily and with confidence.

Tutorial on How to Buy Gold and Silver Bullion Safely

Step 1: Research Trusted Dealers

The first step would be to select a dealer that has a good reputation and a good track record. Verify customer reviews, industry certification and association memberships. A reputed merchant will provide transparency, authentic goods and hassle-free business you are in full confidence.

Step 2: Verify Purity and Authenticity

Always ensure the authenticity of the bullion by looking to see whether it has official stamp of the LBMA, COMEX or the Royal Canadian Mint. These marks are an assurance of quality and purity. Do not buy unverified sellers because there are many fake products in the market and they might incur severe losses.

Step 3: Compare Premiums and Pricing

Know the distinction between the spot price of precious metals and the premium of the dealer. Premiums include minting, handling and distribution. By comparing these with reliable sellers, you will be able to avoid over-paying and yet getting fair value to invest in.

Step 4: Safe Payment Methods

You can use secure online gateways or reliable banking option like bank transfer to make your purchase. Do not use untraceable or risky methods such as cash or wire transfer to accounts that you are not familiar with as it may subject you to fraud and financial hazard.

Step 5: Secure Delivery and Storage

Use insured shipping to insure your purchase during delivery. When received, it is best to store the bullion in a home safe or have it professionally stored in a vault of greater security. Efficient deposits protect your investment in addition to getting peace of mind over the years.

Common Mistakes to Avoid When Buying Bullion

When purchasing bullion, it is best to avoid promotions that appear too good to be true because they have their own dangers connected to them. Always purchase through reputed and authentic sellers so that it is authentic and safe. Storage and insurance are important in securing the investment of many new buyers who forget about them.

The other typical misconception is the mix up of collectible or numismatic coins and bullion; the two are quite unlike in their value and use. Lastly, learn about premiums, which is the charge over the spot price, lest you pay a lot more. You can become more intelligent about the risks of falling into these traps and invest in bullion more wisely and safely.

Secure Your Wealth with Fine Gold Bullion Today!

Need to purchase gold or silver bullion in Canada? The precious metals that we offer at Fine Gold Bullion are the real ones, certified, clearly priced, and delivered as insured. As a new hobbyist or an experienced collector, having a trusted group to deal with is guaranteed to make the process of buying an item an easy and safe experience. Easy to get safe, solid bullion investments that help secure your financial future.