Silver Bullion Brokers: Choosing the Right One for Your Investments

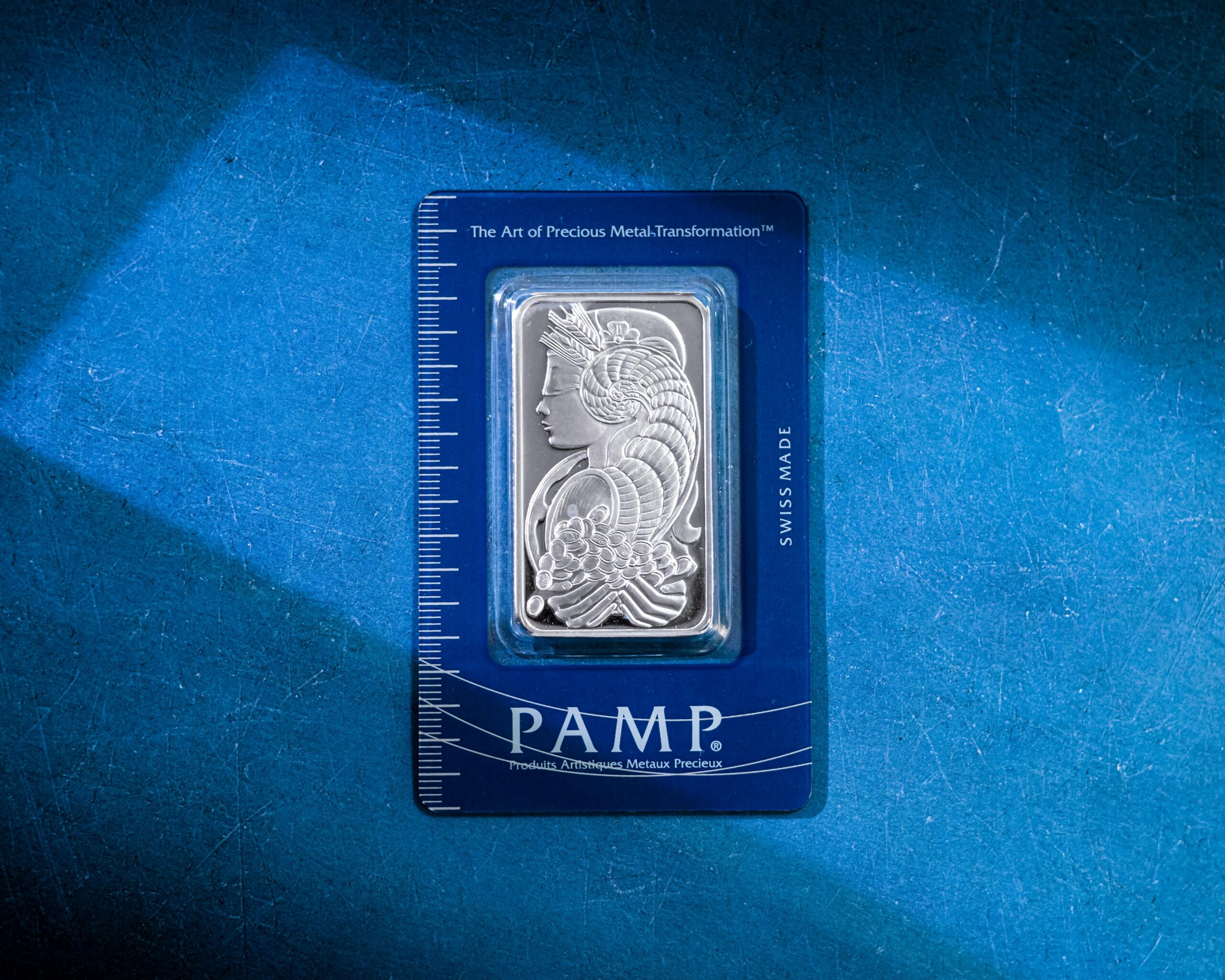

Silver bullion is a time-tested method of preserving wealth and diversification of a portfolio. The success of your investment, however, will be determined by the ability to choose well-known silver bullion brokers. It is important to know what silver bullion is before settling on a broker. Silver bullion is defined as physical silver; bars, coins, and rounds of silver. It gets the value based on silver content and purity. Bullion, unlike collectibles, is subject to the price of silver. A trustworthy broker offers clear and tightly locked pricing to the market rate and offers low premiums. It is important to understand the value of silver to recognize real bargains and not to buy excessively expensive ones.

Understanding Different Types of Silver Bullion Brokers

Online Brokers

Silver bullion banks are common in online markets from where customers can enjoy convenience, transparent and competitive prices as well as fast-trading. They are offering real-time market information, safe payment systems, and delivery at the door. This makes them the right fit to the techno-oriented investors who want to be efficient and cut premiums.

Local Coin Shops

Local coin stores offer face to face transactions so customers can hold and view silver bullion physically before buying silver bullion. Their service is personalized, instant ownership and negotiable prices attract the interest of the traditional investors. They place importance on trust, authenticity, and trade relationships based on the community.

Full-Service Dealers

Full-service dealers do not just sell but can provide portfolio management, secure safe storage facilities as well as professional advice. They serve serious investors and collectors offering personalized investment plans, certified products and full service in purchasing and owning silver.

Wholesale Brokers

The wholesale brokers focus on buying and selling silver in bulk with their main clients being the institutional investors, retailers as well as bulk buyers. They provide volume buying discounts, direct sourcing of mints and logistics support. This made them necessary in case of businesses wishing to purchase silver in a more efficient and profitable way.

Key Factors to Consider When Choosing Silver Bullion Brokers

Reputation and Reviews

Do a background check of the broker in the market before getting into a contract. Select companies that have reputable backgrounds, have been in business a long time, and are open in conducting businesses. Check authentic customer reviews, Better Business Bureau ratings as well as independent review websites to understand credibility and reliability.

Pricing Transparency

Good silver dealer will give transparent and direct information about premiums, spot price and fees. Never trust a company whose costs are unclear or in the process of change. Clear pricing makes you know precisely what you are paying. This also helps to guard against overpaying and against getting an unpleasant inclination of covering up charges subsequently.

Product Range

Prefer brokers that sell a wide variety of gold silver bullion products- coins, bars and rounds of the world-renowned mints. The wide selection of inventory provides a wide choice of options in the amount of investment, liquidity and collectability. This offers both new and experienced investors specific ideas to fulfil their aims.

Buyback Policy

Silver investment is a liquidity issue. Select brokers with easy, fair and efficient buyback programs. This will give you a chance to easily sell your holdings, when necessary, at competitive rates and with little trouble. Hence, this grants you flexibility in your whole investment approach.

Storage and Insurance

Most brokers offer professional vaults storage and insurance to get an extra protection. Assess their security measures, storing point and terms of coverage. Effective storage facilities would protect your silver against theft, loss or damage, your investment is safe and fully insured.

Customer Service

Knowledge and responsive customer service improves your investing experience. Find brokers that will provide good communication, educational materials and after purchase support. Customer care will create trust and make you feel that you are being supported in the process of investing in silver.

Smart Ways to Verify a Broker’s Authenticity

The bullion industry can be subject to fraud thus requiring verification of the brokers. Begin by checking out licensing and accreditation – reputable brokers are registered in recognized trade or regulation organizations.

Check third party feedback and customer rating in terms of consistent satisfaction and reliability. Also check the physical address of the broker and his/her contact details; do not deal with those who do not provide clear business details. Authenticate the products, i.e. certificates of authenticity, serial numbers, and non-tampered packaging.

Finally, check safe payment systems – they should have SSL encryption, a known and trusted payment processor and an easy-to-understand refund or dispute policy. These steps assist in protecting your investment and you are working with a reputable, reliable bullion dealer.

Fees, Premiums, and Hidden Costs Explained

All silver bullion brokers mark up at a higher price than the silver spot price. These include the cost of minting, handling and operational expenses. Different types of products have varying premiums (coins tend to be more expensive than bars). A breakdown of fees should always be requested before buying.

Be careful of other expenses that are not shown to you such as shipping, storage or transaction costs. Seeing all fees beforehand, transparent brokers will make sure that you will know the cost you are paying. By questioning various dealers on the prices of their premiums, you can get the best price on your silver investment.

Mistakes to Avoid When Selecting Silver Bullion Brokers

New investors are in the habit of jumping into silver purchases without checking credentials, comparing premiums, and reviews. It is best to avoid brokers who insist on an immediate sale or are offering a deal that is too good to be true.

You should not buy on online websites and people who are not transparent. Fraud or loss can occur because of lack of product authentication or failure to verify tracking of deliveries. Research before investing – precious metal safety begins with quality research.

Invest Smart and Secure Your Wealth with Fine Gold Bullion!

Looking to elevate your portfolio beyond silver? Fine Gold Bullion offers certified gold bars and coins with unmatched purity, transparency, and secure global delivery. Whether you’re diversifying or safeguarding your assets, our gold bullion products combine long-term stability with superior investment value. Don’t wait for market swings! Start your journey toward lasting financial security today with Fine Gold Bullion.