Ideal Destination for Gold and Silver Investments: Top Factors to Consider

In times of market uncertainty, precious metals like gold and silver remain a trusted choice for many investors. Their lasting value and ability to protect wealth make them appealing when markets are volatile. More people are turning to physical bullion to secure their investments and diversify portfolios. However, where you buy and store these metals matters a lot. The correct location can affect costs, safety, and ease of trade. In this article, you will learn the key factors that make a country an ideal destination for gold and silver investments, helping you make smarter, safer decisions.

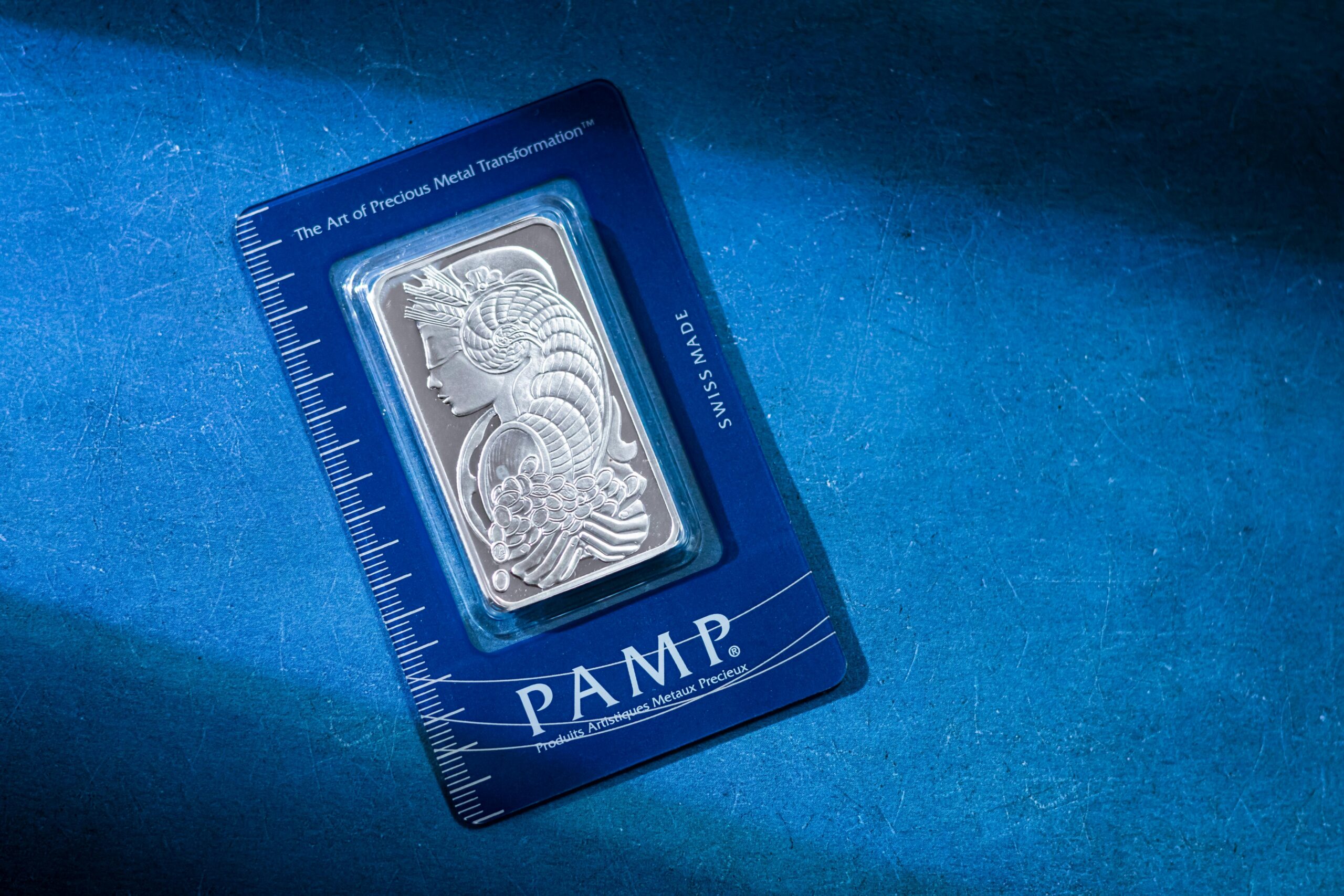

Canada: An Ideal Destination for Gold and Silver Investments

There are many good reasons why Canada is the ideal destination for gold and silver investments. Pure gold bars and coins are not subject to sales tax according to limitations in the law. Thus, investors do not need to worry about extra taxes when they invest, which makes Canada well-liked for metals.

Also, it is essential to consider working with trustworthy dealers and safe vault services. Fine Gold Bullion in Canada looks after your investments by offering 100% covered and safe storage. Because of this security, buyers can feel secure during the transaction.

Canada’s connections with other countries make it possible to buy, sell and move gold and silver with ease. People who purchase Canadian gold are sure they are getting solid metal with a well-known reputation in the industry. For this reason, Canada is a sought-after and ideal destination for gold and silver investments across the world.

Key Factors to Consider When Choosing an Investment Destination

1. Economic and Political Stability

The strong economic and political stability of a country means that there is little risk of sudden changes in its policies or finances. Financial systems which are protected by law prevent capital controls on your investments. Canada is one of those nations that provide a safe environment where investors can store their precious metals. They also give the investors with well-defined trust and security over the long run.

2. Taxation Policies on Precious Metals

VAT and capital gains, for example, directly affect your investment returns. Companies can increase profitability by choosing countries with favourable tax treatment. For instance, Canada does not imply sales tax on gold silver bullion coins or bars. It helps investors to plan better and avoid unexpected costs.

3. Ease of Buying and Selling

Prices move around rather quickly in a liquid market. This also makes local dealers bring specific changes in the quick buying and selling of precious metals. Transparent pricing is beneficial for the investor. They can conduct an open pricing without hidden charges. Also, countries offer the bullion with free trade with transparent and fair laws. They also introduce easier transactions that will enable investors to get into and come out of the market easily.

4. Storage Options and Security

It is essential to protect yourself with secure, insured vaults for storage. Peace of mind is afforded through privacy laws that bind information about ownership of legal firearms. All these factors together guarantee the security of investment from stealing, loss or unauthorized access.

Common Mistakes to Avoid When Investing in Precious Metals

Many investors make avoidable mistakes when they buy gold Canada that can lead to financial loss. One significant error is buying from unverified or unknown sellers. This mistake increases the risk of fraud or receiving fake products. Another common issue is not understanding the difference between numismatic and bullion products. Collectable coins often carry higher premiums but don’t always follow market prices. Ignoring storage and insurance needs can also result in damage or theft, putting your investment at risk. Lastly, failing to check a dealer’s buyback policy may leave you stuck when it’s time to sell. Always research before you invest.

How to Get Started with Gold and Silver Investments?

If you are looking for a good way to build and protect your wealth, then a cash for gold Toronto investment is an excellent choice for you. First, choose a trustworthy and transparent bullion dealer whom you can trust. Always take time to understand if you want to make short-term investment goals and gain long-term financial security. Starting small is the smart thing to do. Always buy limited quantities. This will help you to grow your portfolio later.

Diversification of your holdings reduces the risk and helps with stability. Keeping your assets safe requires secure storage options. Fine Gold Bullion offers safe vault services with the guarantee of 100% security. This platform is the perfect place to step into the precious metals market with confidence and clarity. Above all, investing in gold and silver doesn’t have to be difficult if you do it the right way.

FAQs: Common Questions People Often Ask

- Why is Canada an ideal destination for gold and silver investments?

Canada offers tax exemptions, secure vaults, political stability, and world-renowned dealers like Fine Gold Bullion.

- Is it better to buy coins or bars?

Coins are easier to trade in small quantities; bars offer better value for larger investments.

- Can I store my gold/silver at home?

Yes, but it’s riskier. Professional storage is safer and usually insured.

- Do I pay taxes when I sell my bullion?

It depends on your country’s laws. In Canada, capital gains are applicable, but there has been no sales tax policy on the qualified bullion.

- Is silver a better investment than gold?

Silver is more volatile but has higher industrial demand, making it a strong growth asset compared to gold’s stability.

Secure Your Wealth with Confidence with Fine Gold Bullion!

Looking for a safe, tax-efficient, and profitable way to invest? Fine Gold Bullion offers premium-quality gold and silver bullion, secure storage, and expert service right here in Canada. Whether you’re a first-time investor or building your long-term portfolio, trust our transparent pricing, insured facilities, and commitment to your financial security. Start your precious metals journey today with Fine Gold Bullion, where trust meets tangible wealth.