Buy Silver Bullion – Is Now the Right Time to Invest?

Silver has long held a special place in the investment world, valued for its beauty, industrial demand, and role as a hedge against inflation. In today’s uncertain economic climate, many investors are asking: Is now the right time to buy silver bullion? With fluctuating global markets, rising inflation rates, and increasing geopolitical tensions, silver is regaining attention as a tangible, stable store of value. This guide explores the current market outlook, benefits, risks, and strategies to buy silver bullion so you can make a confident, well-informed decision.

Understanding Why to Buy Silver Bullion as an Asset

Silver bullion acts as a physical asset in bars, coins, or rounds. It is popular for purchasing because of the metal content, not because of collectible rarity. Bullion offers a physical form of wealth storage that has no counterparty risk unlike paper assets. It is an industrial metal whose demand is not just or investment purposes, but rather it is essential in electronics, solar panels and medical equipment. Such a duality means that silver prices are responsive to economic and industrial trends.

Bullion is favorite among investors due to its liquidity, international acceptance, and portfolio diversification. Although the focus is frequently on gold, silver is more attainable because it is more economical to more investors. It is quite important to know these basics before deciding on whether it is the right time to purchase silver bullion.

The Historical Performance of Silver Commodity

The history of the silver price Canada is favorable by the strong volatility and a high growth potential. Silver rose sharply in the late 1970s out of inflation concerns and peaked at inflation-adjusted records. In more recent times, silver has peaked at almost $50 per ounce in times of economic uncertainty (2011). Though prices have since corrected, the appeal of silver to outperform in market stress remains appealing to investors.

Silver is more prone to steeper price fluctuations than gold because it has a smaller market. Being aware of such historical trends assists investors to predict possible market behaviors. History indicates that silver is usually a strong performer when there is monetary easing, geopolitical turbulence or high inflation, all of which are prevailing in the world markets.

Benefits of Investing in Silver Bullion Now

Being affordable is one of the most convincing reasons why an individual should invest in silver bullion. Silver also has the tendency of surpassing gold in percentage terms during bull markets because it has a smaller market. Since 1 oz silver price Canada is being eroded by inflation, it is possible to acquire tangible assets such as silver to store wealth.

Also, the industrial demand of silver offers a basic price bottom not necessarily found in pure investment metals. Silver bullion is suitable as hedge against depreciation of the currency in case of geopolitical or financial uncertainty. Due to its accessibility and its recognition in the global markets, silver presents itself as a smart diversification instrument.

Risks and Considerations Before Buying

Silver has numerous benefits, but it is important to be considerate about the risks as well. The prices of silver may be very volatile with wide fluctuations in the short term. This may give difficulties to investors who may require liquidity at certain periods.

The costs of storing and ensuring gold silver bullion are also a part of the entire investment strategy. The issue of market manipulation has occasionally been raised, due to the smaller market size of silver when compared to that of gold. Also, in an economic boom period, the price of silver can trail off in case industrial demand weakens or investors prefer to invest in assets with higher returns.

Knowing all such risks is necessary to understand the strategic timing, diversification and expectations when investing in the silver bullion market.

Right Timing: When Should You Invest?

It is never easily understood when the right time is to invest in silver. You should be noticing certain signs which can help you to make smart decisions. Analysts observe that silver is cheap in comparison to gold at present. The increase in industrial demand, particularly those in green energy, is likely to continue the upswing in prices in the next few years.

Nevertheless, temporary variations are to be anticipated. This is the major reason why a dollar-cost averaging strategy would be interesting to adopt in terms of risk management. For the investors it is important to protect themselves during the crisis and to have growth potential. In that case, the present situation offers a good reason to buy silver bullion as quickly as possible.

How to Buy Silver Bullion Safely?

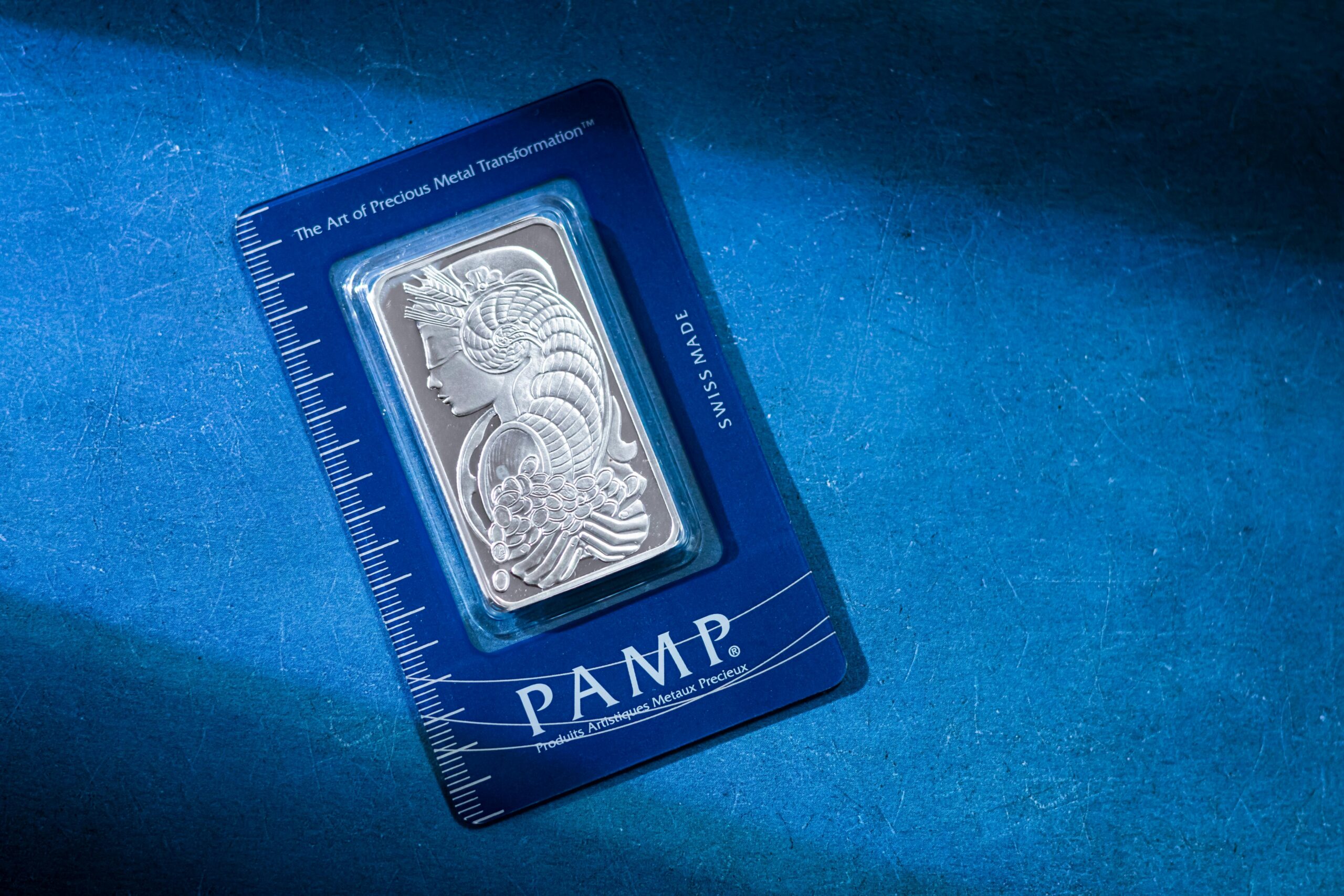

It is important to stay extra careful when buying silver bullion to ascertain its genuineness and worth. Online or face-to-face reputable dealers are selling products of well-known mints with established weight and purity markings, usually .999 fine silver. Buyback policies and certificates of authenticity are additional security. With greater investments, you can think of allocated storage within insured vaults to secure against theft.

Do not get involved in too complex or speculative silver products that expose you to unneeded counterparty risk. It is necessary to compare premiums with the spot price to be cost-effective.

When selecting your coins, bars or rounds, consider more liquidity by selecting recognized brands such as the American Silver Eagle or Canadian Silver Maple Leaf. Prudent buying procedures will protect your investment and profitability in the long term.

Invest in Silver with Fine Gold Bullion, Your Trusted Partner

Investing in silver bullion can be a smart move but pairing it with Fine Gold Bullion creates a stronger, more resilient portfolio. Gold’s stability complements silver’s growth potential, giving you both long-term security and short-term opportunities. Whether you are a seasoned investor or just starting, we offer unmatched liquidity, global recognition, and timeless value. Secure your wealth today with certified, high-purity gold from trusted sources. Act now to protect your future with the ultimate in precious metal security.