Silver Price Movements: Key Indicators Every Investor Should Watch

The allure of silver lies in its unique role as both a valuable investment and a key industrial metal. Known for its long-standing appeal, silver continues to attract investors looking for a smart hedge against inflation and times of economic uncertainty. Its dual demand makes it a dynamic asset, offering both safety and growth. This blog aims to guide investors by shedding light on the main factors that drive silver prices. By understanding these indicators, traders can make better decisions, reduce risk, and increase potential returns. Knowing when and why silver price movements occur is the key to making smarter investments.

Exploring Silver Price Movements for Profitable Returns

Silver is much more than a precious metal. It acts as a powerful financial asset in which both real-world demand and market trends shape silver price movements. From its use in electronics and solar panels to its role as a store of value, silver reacts to a range of economic signals. Industrial demand, currency strength, inflation and interest rates all play a significant role in silver price movements. Understanding all these factors helps investors to make wise decisions in protecting their portfolios. Whether you are exploring the market or planning to invest, knowing these silver price movements enables you to make more confident and smarter decisions.

Key Technical Indicators to Monitor Silver Price Movements

Now, let’s talk about the key technical indicators that play a significant role in monitoring silver price movements. It is essential for every investor to understand these key indicators for making a smart move.

Understanding Silver Price Basics

Changes in silver price Canada occur due to global market demand and supply. Investors often look at silver as a hedge against economic uncertainty and inflation. Knowing the major factors that influence the overall price helps to make wise decisions. This includes investment trends, industrial demand and mining output.

Spot Price vs. Futures Price

Understanding the main difference between the spot price and the future price is another essential element to be careful of. Spot price is basically the current market price for immediate delivery. On the other hand, future prices are contracts to sell or buy silver at a future date. Keeping an eye on both gives insight into market sentiment and short-term trends. Noticing a widening gap between them is an alarm towards future price shifts.

US Dollar Strength

We all know that silver is always priced in US dollars. In such cases, any impact on the dollar will directly affect silver prices. When the dollar is in a weak state, silver becomes affordable for buyers. It eventually raises the price. But if the dollar is strong, the silver price faces a certain downfall.

Inflation and Interest Rates

During high inflation times, a 10-ounce silver bar always performs well. It is seen as a store of value when money starts losing its purchasing power. Meanwhile, the interest rate also plays a significant role. Lower rates make holding non-yielding assets like silver more attractive. On the other side, rising rates may shift investor interest elsewhere.

Industrial Demand Trends

Calling silver just as an investment asset is a wrong statement. It has a wide use in medical devices, solar panels and electronics. An immense demand in the industrial sector also supports price growth. Monitoring manufacturing and tech sectors helps to predict price shifts very easily.

Geopolitical Events and Uncertainty

Tensions between trade, countries conflict, and political instability can drive investors towards the investment of silver assets. During global tension, silver sees a sudden increase in demand. Watching international developments and news helps to figure out potential surges in interest and price.

Smart Ways to Invest in Silver: Pro Tips for Success

Choosing silver as your investment asset is the smart choice to protect your money and build wealth during inflation. While it is not as profitable as gold, it still silver offers strong growth potential and real value. There are some expert tips to follow when starting with the investment journey.

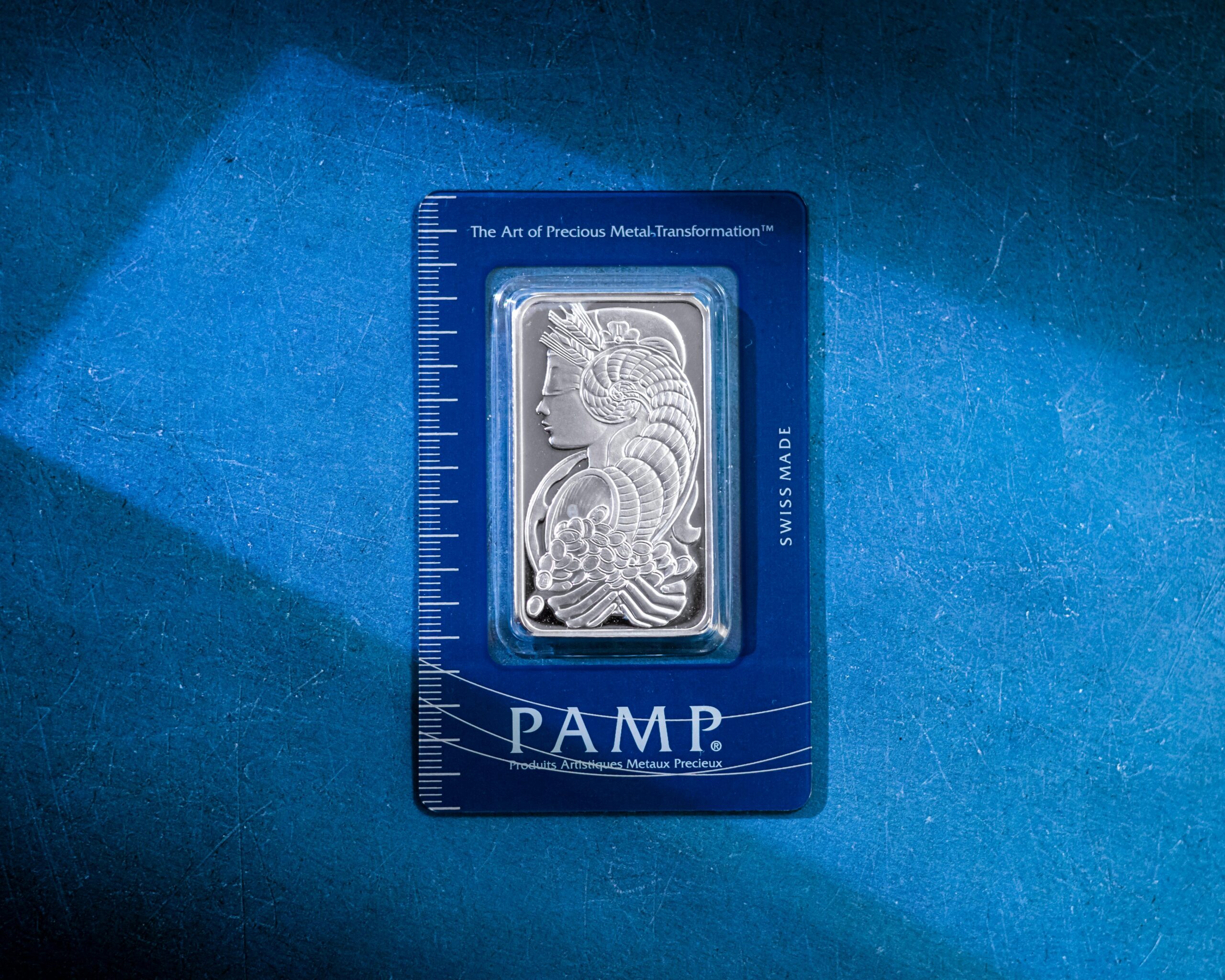

Understanding how the market reacts to silver prices is very important. You should first learn how the market works during the buying and selling process. 1 oz silver price Canada can vary depending on global trends, demand and supply. Watching price charts and news can help to make wise decisions. Meanwhile, choosing the proper form is equally important. You can select either bars, coins, mining stocks or ETFs. Bars and coins are excellent for holding physical silver. If you don’t want to store metal, then ETFs are an excellent choice.

In addition, buy from reliable and well-known dealers. Check for certifications and purity to make the right choice within your budget. Silver has always remained the best choice for long-term investment. But don’t put all your money at once. Start with smaller portions, and once you make profits, you can add more portions with time.

FAQs: Common Questions People Often Ask

- After how long time should I check silver price indicators?

Long-term investors should check weekly, and short-term traders should check daily. Changes in market events also require constant monitoring.

2. Is silver more volatile than gold?

Silver has a greater price swing due to higher industrial use and smaller market size.

3. Why is silver a good hedge during inflation?

This metal asset retains its intrinsic value. It often outperforms during periods of inflation and fiat currency weakness.

4. Should I invest in physical silver or ETFs?

Physical silver has direct ownership with no risk of counterparty. ETFs come with ease of trading and liquidity, but it also involves storage fees and management.

Buy or Sell Silver with a Trusted Platform of Fine Gold Bullion

Whether you are a beginner or a seasoned investor, Fine Gold Bullion offers a competitive, transparent and secure selling or buying process for silver. Our real-time marketing pricing, wide collection and trusted advisors ensure you make smart decisions at the right time. With us, you don’t just invest; you are giving an increase to your wealth in a seamless and stress-free manner. Contact us now and invest in silver with complete confidence.