Value of Silver Bullion | Considered a Safe Haven for Investment?

Some call silver bullion a “safe haven” when the economy is uncertain, even though it has long been popular as a reliable and safe investment. Silver is a good choice if you want to buy something stable because its value is still high, unlike stocks or bonds. The way it looks, historical value, and business benefits makes value of silver bullion more appealing. Bearish silver is a must-have thing to keep your money safe and make your investments grow. This is because it keeps the currency from losing value and keeps the economy stable during market chaos or inflation.

What Is Value of Silver Bullion So High?

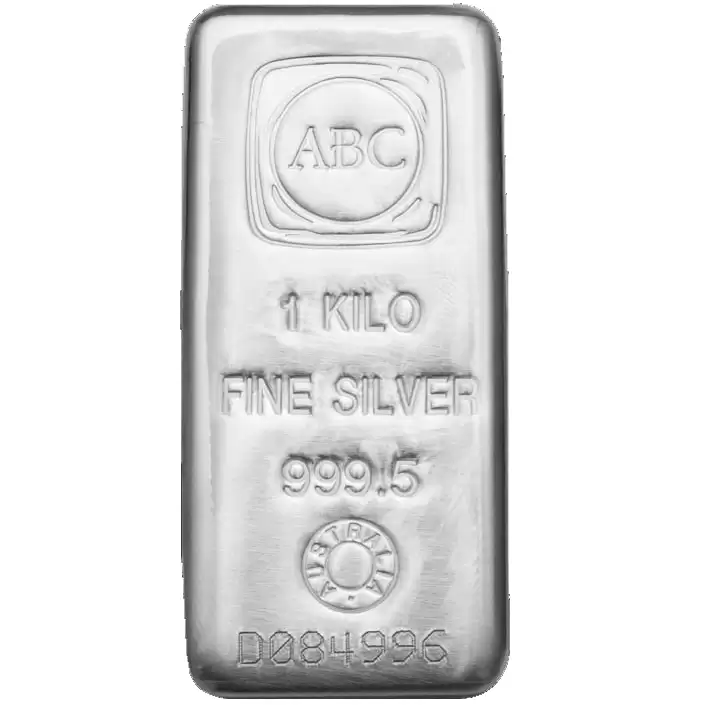

Silver bullion comes in bars, coins, or ingots and is available from pure silver. People store their money in it because it is so pure—often 99.9% or more. The metal inside bullion makes it valuable, not how it looks or how well it was available, like industrial silver. On the world commodities market, you can buy and sell it. This makes it a liquid asset for buyers who want to add tangible assets.

Silver has excellent value and has been suitable for a long time to preserve riches; hence, people view it as a safe buy. Silver is always a fantastic strategy to guard your money when the economy is uncertain, or the market is erratic since its value remains the same or even increases. Since paper investments—stocks and bonds—have a tangible shape, those who mistrust them can also feel safe purchasing them. Furthermore, unlike money, the government cannot print silver, indicating that it will always be secure.

How Does Silver Compare to Gold as a Safe Haven?

Like gold, value of silver bullion is popular to be safe. In a recession, it can help you to safeguard your money. A greater spectrum of consumers find silver more enticing since it is less expensive and easier to obtain. Gold is still famous as the best security against financial catastrophes and inflation. It’s also more used than gold. Hence, value of silver bullion might vary from that of gold in other respects. Both gold and silver are good places to invest your money, but since silver is less expensive.

What Factors Influence the Value of Silver?

- Industrial Demand: Many people use silver in electronics, health care, solar energy, and other areas. Silver is best to use in medicine. The price of silver can change a lot when these things happen. For example, as solar technology improves or the number of electric cars grows, more people will want silver, increasing its value.

- Market Trends: Like other things, the 1 oz silver price Canada changes based on how much people want and need it. If prices go up or down or the economy grows or shrinks, the cost of silver could change. The prices of silver futures shift a lot when people trade them to make money.

- Geopolitical Events: People sometimes consider silver a haven during war or economic trouble because it is valuable. As an investment, silver can be a safe choice. Wars, trade disputes, or monetary penalties can make more people want to buy it.

- Role as a Store of Value: People have long thought that silver would keep its value. It’s very useful when the economy is terrible or there is a lot of inflation. By understanding its buying power, you can know its worth in the market.

Is Silver Bullion a Good Investment for Long-Term Growth?

Silver bullion could be a decent long-term investment for those who wish to fight against inflation. Over time, silver’s value has remained constant. Silver prices usually rise as the market declines or the economy suffers.

Your savings would be better secure from silver than from equities or bonds. This is so because it does not vary depending on the performance of businesses or the changes in interest rates. Over the long run, silver has been consistently rising. It is suitable to use in business and as a means of savings, which is helpful in uncertain times.

What Are the Benefits of Investing in Silver Bullion?

Investing your money in silver coins will help you distribute your wealth, prevent inflation, and offer opportunities for 1 OZ silver price rises during the recession. A few of its outstanding advantages are:

- Protection Against Inflation: Past inflation has been secure enough using silver. Over time, paper money is worth less; gold and silver are worth more. When inflation is high, many who wish to safeguard their cash rush to make serious investments including precious metals. This is the reason silver’s price increases. Silver bullions enable buyers to maintain their purchasing capability while the value of money declines.

- Diversification: Adding silver to your investments is a good way to make them more interesting. When the market is unstable, its silver price Canada changes aren’t always part of the stock market or other traditional financial assets. This keeps you safe. Adding silver coins to a diversified portfolio makes you less likely to lose money on one type of asset. This can be very helpful when the market is unstable because silver might do better than other investments that aren’t doing well.

- Price Appreciation During Economic Crises: Value of silver bullion may be worth more when the market is unstable or the business is terrible. It often increases in value during political unrest, financial trouble, or global market turmoil because it is seen as a safe shelter asset. When the economy is terrible, silver prices go up. This makes it a good long-term investment because you can make money over time.

What Risks Are Involved with Investing in Silver Bullion?

Putting money into silver bullion is risky because the value of silver bullion changes constantly. Silver prices can change a lot when things happen in the world economy, politics, or desire for goods. Investors also worry about how to store silver coins properly. They need to be kept in safe places or vaults to keep them safe from theft or damage.

It could be hard for some buyers to get their money out because silver might not sell or hit the price they want for longer. It is essential to be careful with silver purchases because of these risks. When you look for where to buy silver bars near me, make sure you find stores or dealers which are authentic.

How Does Silver Perform During Periods of Inflation?

People often buy silver as a hedge against price increases since it does well when prices rise. Real things, like silver, tend to go up in value when inflation makes fiat currency less valuable. Many want to buy silver because it doesn’t lose value over time as money does. In the past, when inflation was high, the price of silver went up. This gave buyers a way to protect their money. Silver is an excellent investment when the market isn’t transparent.

FAQs

- Can silver bullion be used as currency?

For a long time, silver was used as money. These days, it’s more often used as an investment than for everyday purchases.

- How do I store my silver bullion?

It is safe to keep silver coins in a safety deposit box or in private storage that is locked up.

- How can silver bullion diversify my investment portfolio?

Buying in silver bullion gives people access to valuable metals while lowering the risk of buying stocks or bonds.

- Should I invest in silver bullion during economic uncertainty?

It was a smart buy since silver metal is often seen as a safe way to make money when times are tough.

Secure Your Wealth for Future Investments with Fine Gold Bullion

When you buy pure gold from Fine Gold Bullion, you can be sure it will be safe. No matter your goals, our premium gold bullion will always be worth something. Investing in gold with us is easier because we offer fair prices, safe storage choices, and easy transfers. Just like many other buyers, you can protect your future money with Fine Gold Bullion. Gold has always been worth some money. It’s time to buy with hope now!